- The total market size of PROTAC in the leading markets is expected to surge significantly by 2034.

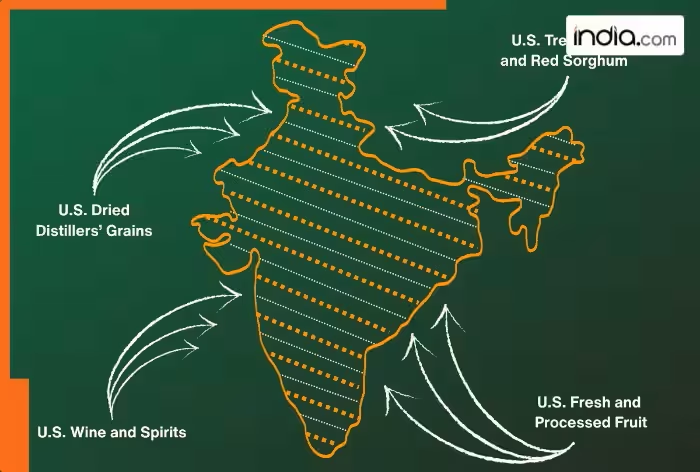

- The report provides the total potential number of patients in the indications, such as HR+/HER2− Breast Cancer, Triple Negative Breast Cancer (TNBC), Metastatic Castration-resistant Prostate Cancer, Colorectal Cancer, Non-small Cell Lung Cancer (NSCLC), and others.

- Approximately 85% of patients diagnosed with metastatic breast cancer have had an early-stage breast cancer diagnosis. However, most patients with early-stage breast cancer do not go on to develop metastatic disease.

- Leading PROTAC companies, such as Arvinas (NASDAQ: ARVN), Pfizer (NYSE: PFE), Novartis (SWX: NOVN), Astellas Pharma (TYO: 4503), Dialectic Therapeutics, and others, are developing novel PROTAC that can be available in the PROTAC market in the coming years.

- Some of the key PROTACs in clinical trials include Vepdegestrant, Luxdegalutamide, ASP3082, DT2216, and others.

- High Therapeutic Potential and Mechanism of Action: PROTACs offer a novel mechanism that selectively degrades disease-causing proteins rather than simply inhibiting them. This expands therapeutic possibilities, especially for targets previously considered “undruggable”, boosting industry and investor interest.

- Rising Prevalence of Target Diseases: The increasing global burden of complex diseases, such as breast cancer, TNBC, mCRPC, colorectal cancer, NSCLC, and others, fuels the demand for innovative treatment options. PROTACs’ ability to target pathogenic proteins drives research and clinical investment.

- Next-Generation AR Degradation in Mutant Androgen Receptor–Driven Prostate Cancer: Prostate cancer is traditionally treated with anti-androgen medications. However, PROTACs such as ARV-766 are thought to be effective in patients with AR that has mutated, particularly through a resistance mechanism such as L702H. ARV-766 has a superior and expanded efficacy profile and an improved tolerability profile compared with bavdegalutamide.

- Pharmaceutical Partnerships and Licensing Landscape: Opportunities for clinical collaboration and licensing with large pharmaceutical companies are presented here. Novartis paid USD 150 million up front, primarily for the rights to Arvinas’s androgen receptor degrader ARV-766, thereby providing the company a second endorsement of its degradation strategy. It is important to note that Pfizer is already a partner with Arvinas for the PROTAC vepdegestrant.

- Emerging PROTAC Drugs in Development: Some of the potential drugs in the pipeline include vepdegestrant (Arvinas and Pfizer), luxdegalutamide (Arvinas and Novartis), ASP3082 (Astellas Pharma), DT2216 (Dialectic Therapeutics), and others.

- Targeted Protein Degradation (TPD) is an emerging therapeutic modality with the potential to target disease-causing proteins that have historically been difficult to reach with conventional small molecules.

- PROTACs are a key class of targeted protein degradation technologies, and over the past 20 years, the concept of harnessing the ubiquitin–proteasome system has evolved from academic research into active industry-led drug development.

- Nearly 90 protein degradation–based leads are currently under evaluation, with close to 20% of pipeline candidates in clinical development and the remainder in preclinical or discovery stages.

- PROTACs account for more than 30% of all protein degradation pipeline drugs, underscoring their growing prominence in this therapeutic space.

- The PROTAC market is expected to expand significantly in the coming years, driven by the rising number of PROTAC-designed molecules entering clinical trials, despite the absence of any approved therapies to date.

- The first PROTAC molecule, ARV-110, entered clinical testing in 2019, marking a major milestone for the modality.

- In 2020, early clinical data provided the first proof-of-concept for PROTACs against well-established cancer targets, including the estrogen receptor (ER) and androgen receptor (AR).

- Pfizer, in collaboration with Arvinas, is currently evaluating vepdegestrant in clinical trials as both a monotherapy and in combination regimens for ER+/HER2- breast cancer and other indications.

- Several major players, including Arvinas and Pfizer (Vepdegestrant), Arvinas and Novartis (Luxdegalutamide), Astellas Pharma (ASP3082), Dialectic Therapeutics (DT2216), and others, are advancing PROTAC-based therapies across multiple oncology indications such as ER+/HER2- breast cancer and metastatic prostate cancer.

- Overall, PROTACs represent an exciting and rapidly maturing class of therapeutic agents, with ongoing and future studies expected to clarify their clinical role in cancer and other diseases.

- In November 2025, Arvinas presented multiple abstracts on vepdegestrant at the San Antonio Breast Cancer Symposium (SABCS).

- In October 2025, Arvinas announced new patient-reported outcomes data from the Phase III VERITAC-2 clinical trial evaluating vepdegestrant, which are being presented in a mini oral session at the 2025 European Society for Medical Oncology (ESMO) Congress.

- In March 2025, Arvinas and Pfizer announced positive topline results from the Phase III VERITAC-2 trial, which met its primary endpoint in the ESR1m population, showing a significant improvement in progression-free survival (PFS) compared to fulvestrant, exceeding the pre-specified target Hazard Ratio (HR) of 0.60. However, the trial did not reach statistical significance in the intent-to-treat (ITT) population.

- Total Cases of Selected Indications for PROTAC

- Total Eligible Patient Pool for PROTAC in Selected Indications

- Total Treated Cases in Selected Indications for PROTAC

|

PROTAC Report Metrics |

Details |

|

Study Period |

2020–2034 |

|

PROTAC Report Coverage |

7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

|

Key Indications Covered in the Report |

HR+/HER2− Breast Cancer, Triple Negative Breast Cancer (TNBC), Metastatic Castration-resistant Prostate Cancer, Colorectal Cancer, Non-small Cell Lung Cancer (NSCLC), and others |

|

PROTAC Target Patient Pool Segmentation |

Total Cases of Selected Indications for PROTAC, Total Eligible Patient Pool for PROTAC in Selected Indications, and Total Treated Cases in Selected Indications for PROTAC |

|

Key PROTAC Companies |

Arvinas (NASDAQ: ARVN), Pfizer (NYSE: PFE), Novartis (SWX: NOVN), Astellas Pharma (TYO: 4503), Dialectic Therapeutics, and others |

|

Key PROTACs |

Vepdegestrant, Luxdegalutamide, ASP3082, DT2216, and others |

- PROTAC Therapeutic Assessment: PROTAC’ current marketed and emerging therapies

- PROTAC Market Dynamics: Conjoint Analysis of Emerging PROTAC Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, PROTAC Market Access and Reimbursement

|

1 |

PROTAC Market Key Insights |

|

2 |

PROTAC Market Report Introduction |

|

3 |

Executive Summary |

|

4 |

Key Events |

|

5 |

Epidemiology and Market Forecast Methodology |

|

6 |

PROTAC Therapies Market Overview at a Glance |

|

6.1 |

Clinical Landscape (Analysis by Molecule Type, Phase, and Route of Administration [RoA]) |

|

6.2 |

Market Share (%) Distribution by Indications of PROTAC Therapies in 2028 |

|

6.3 |

Market Share (%) Distribution by Therapies of PROTAC Therapies in 2036 |

|

7 |

Background and Overview |

|

8 |

Treatment Guidelines |

|

9 |

Epidemiology and Patient Population |

|

9.1 |

Key Findings |

|

9.2 |

Assumptions and Rationale: 7MM |

|

9.3 |

Epidemiology Scenario in the 7MM |

|

9.3.1 |

Total Cases of Selected Indications for PROTACs in the 7MM |

|

9.3.2 |

Total Eligible Patient Pool for PROTACs in Selected Indications in the 7MM |

|

9.3.3 |

Total Treated Cases in Selected Indications for PROTACs in the 7MM |

|

10 |

Emerging PROTAC Drugs |

|

10.1 |

Key Cross Competition |

|

10.2 |

Vepdegestrant (ARV-471): Arvinas and Pfizer |

|

10.2.1 |

Product Description |

|

10.2.2 |

Other Development Activities |

|

10.2.3 |

Clinical Development |

|

10.2.3.1 |

Clinical Trial Information |

|

10.2.4 |

Safety and Efficacy |

|

10.2.5 |

Analyst’s Views |

|

10.3 |

Luxdegalutamide (ARV-766): Arvinas and Novartis |

|

List to be continued….. |

|

|

11 |

PROTAC Therapies Market: Seven Major Market Analysis |

|

11.1 |

Key Findings |

|

11.2 |

PROTAC Market Outlook |

|

11.3 |

Conjoint Analysis |

|

11.4 |

Key PROTAC Market Forecast Assumptions |

|

11.5 |

Total PROTAC Market Size by Country in the 7MM |

|

11.6 |

Total PROTAC Market Size by Indications in the 7MM |

|

11.7 |

Total PROTAC Market Size by Therapies in the 7MM |

|

11.8 |

The United States PROTAC Market Size |

|

11.8.1 |

Total PROTAC Market Size by Indications in the United States |

|

11.8.2 |

Total PROTAC Market Size by Therapies in the United States |

|

11.9 |

EU4 and the UK PROTAC Market Size |

|

11.1 |

Japan PROTAC Market Size |

|

12 |

PROTAC Market Unmet Needs |

|

13 |

PROTAC Market SWOT Analysis |

|

14 |

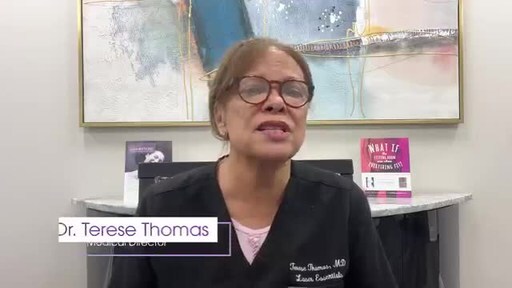

KOL Views on PROTAC |

|

15 |

PROTAC Market Access and Reimbursement |

|

15.1 |

The United States |

|

15.2 |

In EU4 and the UK |

|

15.3 |

Japan |

|

15.4 |

Summary and Comparison of Market Access and Pricing Policy Developments in 2025 |

|

15.5 |

Market Access and Reimbursement of PROTAC Therapies |

|

16 |

Bibliography |

|

17 |

PROTAC Market Report Methodology |

[email protected]

+14699457679 Logo: https://mma.prnewswire.com/media/1082265/3528414/DelveInsight_Logo.jpg SOURCE DelveInsight Business Research LLP

Source link

Leave a Reply