PUNE, India, Feb. 4, 2026 /PRNewswire/ — For nearly a decade, robotic surgery was sold as progress. Hospitals bought systems, surgeons got trained, brochures spoke about precision and innovation. What rarely got discussed was a harder question: does this technology actually pay back—clinically and financially—when scaled inside a real hospital system?

That question is now unavoidable.

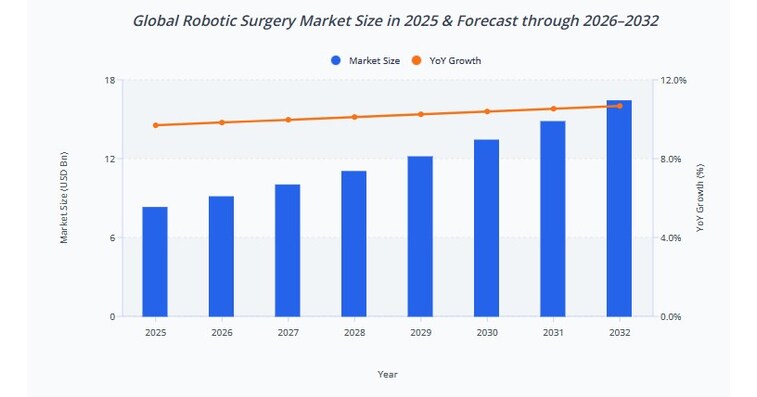

According to deep-dive analysis by MMR Statistics, the global robotic surgery market, valued at USD 8.28 billion in 2025, is projected to reach approximately USD 16.4 billion by 2032, growing at a ~10.2% CAGR. But focusing on growth alone misses the real story. The market is entering a phase where returns are diverging sharply—between hospitals that understand how robotic surgery works as a system, and those that treat it as a machine.

What Changed in the Last Three Years

Three structural shifts have quietly rewritten the economics of robotic surgery.

First, clinical expectations have hardened. Robotic-assisted procedures are no longer judged against open surgery alone. They are benchmarked on length of stay, complication rates, conversion rates, and surgeon throughput. In several high-volume procedures, robotic platforms are now expected to reduce hospital stay by 1–2 days, cut post-operative complications by 15–30%, and improve procedural precision—outcomes that directly affect hospital cost structures.

Get Full PDF Free Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.mmrstatistics.com/reports/795456/global-robotic-surgery-market/contact?type=sample

Second, capital pressure has intensified. A single robotic surgical system typically requires USD 1.5–2.0 million in upfront investment, excluding annual maintenance, disposable instruments, software upgrades, and training costs. What changed is not the price—but tolerance. CFOs are no longer willing to park such capital unless utilisation crosses defined thresholds.

Third, software and data have entered the operating room. AI-enabled navigation, imaging integration, and procedural analytics are no longer add-ons. They are increasingly where margins sit. Hardware may get a hospital into the game, but software determines whether it wins.

This combination has turned robotic surgery from a prestige investment into a performance-sensitive asset.

Market Snapshot — And Why These Numbers Make Boards Nervous

said Rucha Deshpande, Senior Research Manager, MMR Statistics. Related Reports: Robotic Process Automation Market – https://www.mmrstatistics.com/reports/530170/robotic-process-automation-market Robots in Agriculture Market – https://www.mmrstatistics.com/reports/541697/robots-in-agriculture-market Complementary and Alternative Medicine Market – https://www.mmrstatistics.com/reports/842916/complementary-and-alternative-medicine-market Functional Brain Imaging Systems Market – https://www.mmrstatistics.com/reports/410972/functional-brain-imaging-systems-market Global In Vitro Diagnostics Market – https://www.mmrstatistics.com/reports/592500/global-in-vitro-diagnostics-market Why MMR Statistics MMR Statistics approaches the robotic surgery market not as a technology trend, but as a business system—combining clinical outcomes, value pool logic, and execution risk. This enables stakeholders to move from curiosity to decision clarity. MMR Statistics’ work in robotic surgery goes beyond market sizing into procedure-level economics, utilisation modelling, and execution risk analysis. The firm has built deep expertise across robot-assisted urology, gynecology, general surgery, and emerging multi-specialty platforms, analysing not just adoption trends but case-mix feasibility, surgeon learning curves, utilisation break-even thresholds, and software-driven margin pools. MMR’s robotic surgery research is routinely used by hospital groups, device manufacturers, and investors to answer hard questions around ROI timing, capacity planning, platform selection, and regional scalability—areas where generic market reports typically fall short. This hands-on, systems-level understanding allows MMR Statistics to translate complex robotic surgery data into decision-ready insight, not just industry commentary. Robotic surgery is no longer a symbol of modern medicine.

It is a mirror—showing which hospitals are operationally ready for the future, and which are not. Contact:

Lumawant Godage

Visit Our Web Site : https://www.mmrstatistics.com/

Email: [email protected]

Phone :+91 9607365656

Follow us on:

Linkedin – https://www.linkedin.com/company/mmrstatistics/

Facebook – https://www.facebook.com/mmrstatistics

Instagram – https://www.instagram.com/mmrstatistics/

Youtube – https://www.youtube.com/@mmrstatistics Global Office :

Navale IT park Phase 3

Pune-Bangalore Highway,

Narhe, Pune, Maharashtra 411041, India Photo – https://mma.prnewswire.com/media/2876917/MMR_Statistics.jpg SOURCE MMR Statistics

- Global Market Size (2025): USD 8.2–8.3 Bn

- Projected Market Size (2032): ~USD 16.4 Bn

- CAGR (2025–2032): ~10.2%

- Installed Base: 6,700+ robotic systems globally

- Primary Procedure Volumes: Urology, Gynecology, General Surgery

- Fastest-Growing Value Layer: AI software, analytics, training & services

- Value Leader: North America

- Fastest Adoption Growth: Asia-Pacific

- High-frequency procedures such as prostatectomy, hysterectomy, and selected general surgeries.

- Tertiary hospitals with consistent elective case flow.

- Software upgrades and AI-enabled modules.

- Training, certification, and simulation ecosystems.

- Multi-specialty utilisation of the same platform.

- Hospitals that push utilisation across departments.

- Systems that shorten learning curves and reduce surgeon fatigue.

- Vendors that monetise data and workflow intelligence, not just instruments.

- Single-specialty deployments.

- Low-volume centres chasing prestige.

- Robots treated as isolated assets instead of integrated service lines.

- The global robotic surgery market stands at USD 8.2–8.3 Bn (2025) and is projected to reach ~USD 16.4 Bn by 2032, reflecting a ~10.2% CAGR — but returns are increasingly uneven across hospitals, not uniform across adoption.

- A single robotic surgical system typically requires USD 1.5–2.0 Mn in upfront capital, with USD 150k–200k in annual maintenance costs, excluding consumables and software upgrades — pushing ROI scrutiny into the boardroom.

- MMR Statistics’ analysis indicates that hospitals generally need 100–150+ robotic procedures per system per year to approach operational break-even; utilisation below this level materially erodes ROI.

- In high-volume applications, robotic-assisted procedures have demonstrated 15–30% lower complication rates and 1–2 days reduction in average length of stay, directly impacting cost of care and bed availability.

- Software, analytics, and services now account for an estimated 15–20% of total market value, growing faster than core hardware sales as hospitals prioritise optimisation over expansion.

- The global installed base has crossed 6,700 robotic systems, but utilisation efficiency — not system count — is emerging as the key performance differentiator.

- CEOs: Do we have the operational discipline to extract value from robotics?

- CFOs: What utilisation rate makes this investment rational—not aspirational?

- Clinical Heads: Are surgeons trained, scheduled, and supported—or just equipped?

- Strategy Teams: Are we building a robotic service line, or collecting machines?

said Rucha Deshpande, Senior Research Manager, MMR Statistics. Related Reports: Robotic Process Automation Market – https://www.mmrstatistics.com/reports/530170/robotic-process-automation-market Robots in Agriculture Market – https://www.mmrstatistics.com/reports/541697/robots-in-agriculture-market Complementary and Alternative Medicine Market – https://www.mmrstatistics.com/reports/842916/complementary-and-alternative-medicine-market Functional Brain Imaging Systems Market – https://www.mmrstatistics.com/reports/410972/functional-brain-imaging-systems-market Global In Vitro Diagnostics Market – https://www.mmrstatistics.com/reports/592500/global-in-vitro-diagnostics-market Why MMR Statistics MMR Statistics approaches the robotic surgery market not as a technology trend, but as a business system—combining clinical outcomes, value pool logic, and execution risk. This enables stakeholders to move from curiosity to decision clarity. MMR Statistics’ work in robotic surgery goes beyond market sizing into procedure-level economics, utilisation modelling, and execution risk analysis. The firm has built deep expertise across robot-assisted urology, gynecology, general surgery, and emerging multi-specialty platforms, analysing not just adoption trends but case-mix feasibility, surgeon learning curves, utilisation break-even thresholds, and software-driven margin pools. MMR’s robotic surgery research is routinely used by hospital groups, device manufacturers, and investors to answer hard questions around ROI timing, capacity planning, platform selection, and regional scalability—areas where generic market reports typically fall short. This hands-on, systems-level understanding allows MMR Statistics to translate complex robotic surgery data into decision-ready insight, not just industry commentary. Robotic surgery is no longer a symbol of modern medicine.

It is a mirror—showing which hospitals are operationally ready for the future, and which are not. Contact:

Lumawant Godage

Visit Our Web Site : https://www.mmrstatistics.com/

Email: [email protected]

Phone :+91 9607365656

Follow us on:

Linkedin – https://www.linkedin.com/company/mmrstatistics/

Facebook – https://www.facebook.com/mmrstatistics

Instagram – https://www.instagram.com/mmrstatistics/

Youtube – https://www.youtube.com/@mmrstatistics Global Office :

Navale IT park Phase 3

Pune-Bangalore Highway,

Narhe, Pune, Maharashtra 411041, India Photo – https://mma.prnewswire.com/media/2876917/MMR_Statistics.jpg SOURCE MMR Statistics

Source link

Leave a Reply